Trump’s Plan For AI Dominance Threatened by His Own Attacks on Solar, Wind Power

(Bloomberg) -- The Trump administration is moving to fast-track the construction of power-hungry data centers as a matter of national security. At the same time, it’s adding roadblocks for new solar and wind farms.

But the two policies could be at odds: Hindering renewable energy projects risks slowing the AI boom — and could exacerbate rising electricity prices, a slew of data suggests.

“It’s an all-hands-on-deck moment right now to get the power to supply this,” said Robert Whaley, director of North American power at Wood Mackenzie, an energy consultancy. “In the next 10 years, there’s really nothing to replace renewables.”

The AI explosion — and its energy demands — is happening much faster than the pace at which utilities typically plan and build large power plants. In response, tech giants like Meta Platforms Inc. and Alphabet Inc.’s Google have taken extreme measures to keep up, cobbling together data centers in tents and signing contracts for their own power plants.

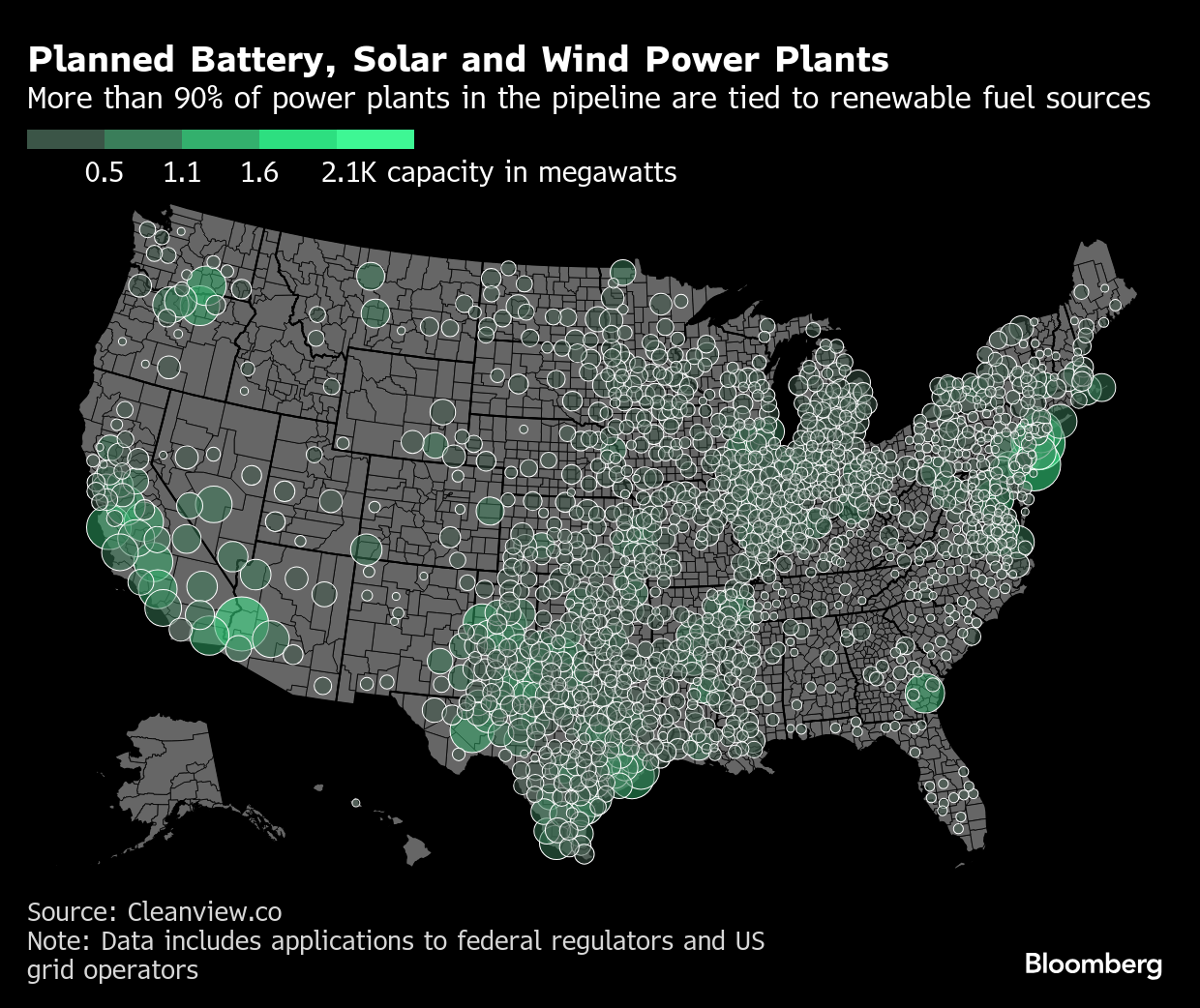

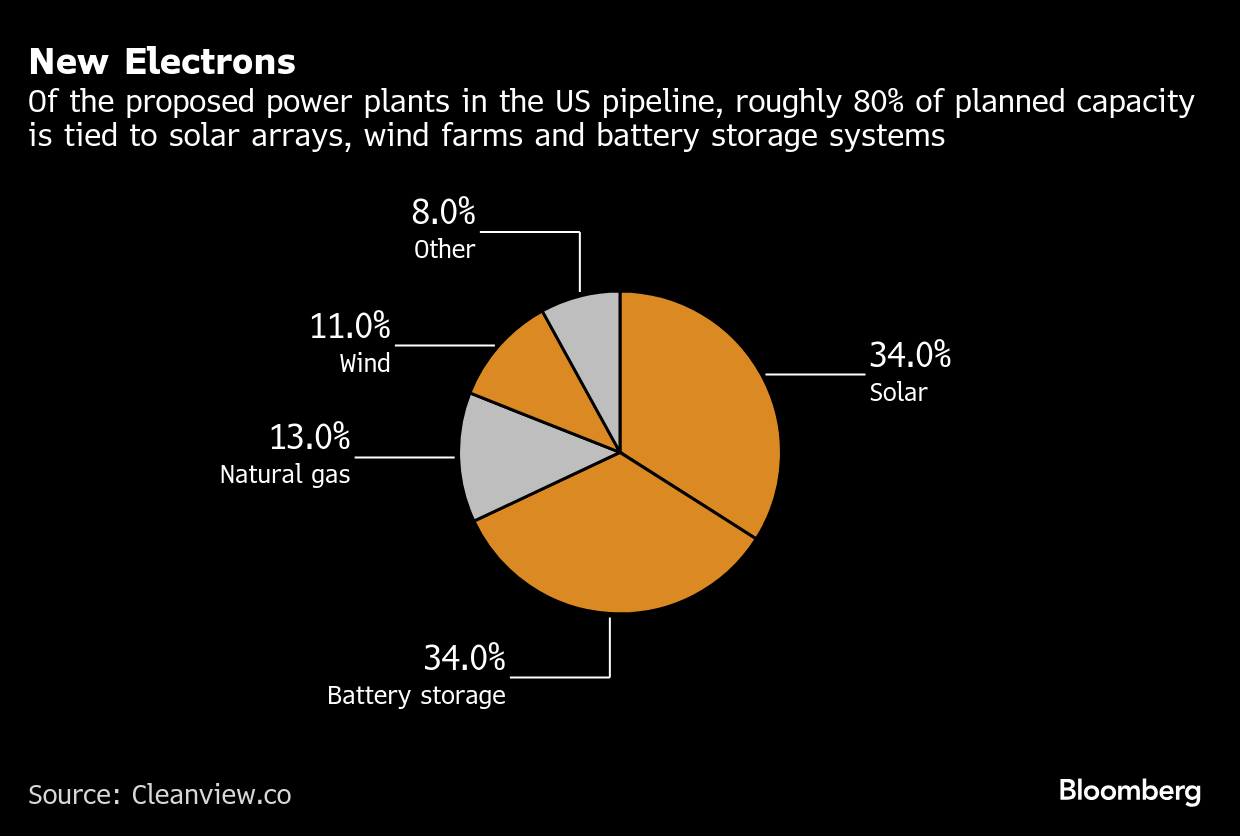

Renewable energy so far remains the fastest and cheapest option to add power to the grid. Nearly 80% of the planned power plant capacity in the pipeline is tied to renewable sources, according to filings with federal regulators and grid operators compiled by Cleanview.co, an energy data company.

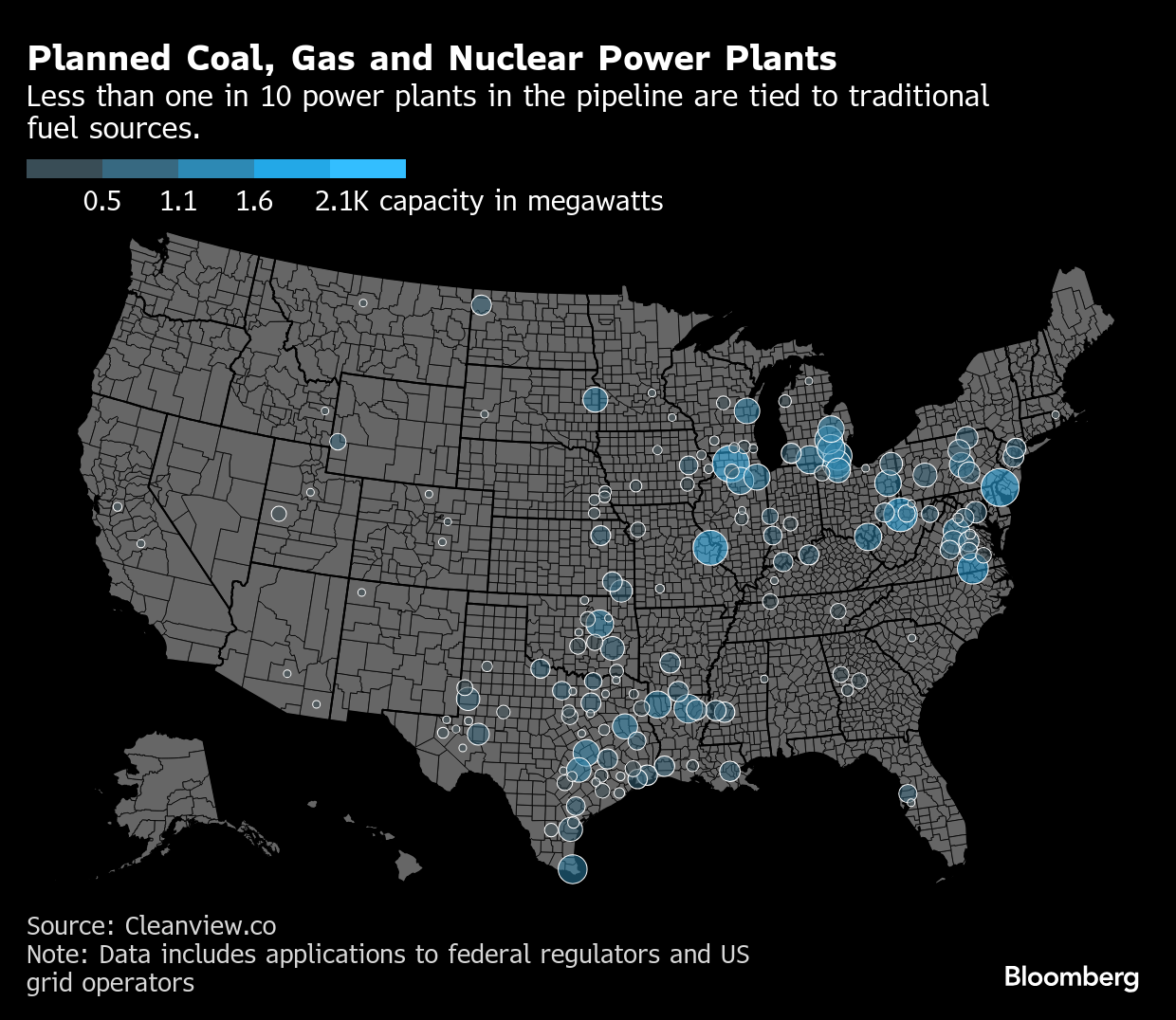

The number of applications for natural gas and nuclear facilities, the options President Donald Trump is embracing to power the AI surge, is much smaller, making up about 14% of planned capacity.

The dynamic creates a potential political challenge for Trump, whose goal of using the AI boom as an engine for the American economy risks blowback at the ballot box if voters blame the data centers he's championed for higher power bills.

AI’s voracious need for electricity is likely to keep renewables growing, but every thwarted green energy project means fewer electrons added to the grid to ease the supply crunch, analysts say.

That’s not to say natural gas, the most viable and cheapest of the president’s preferred energy sources, won’t play a role in powering AI: Unlike solar and wind, which are intermittent, gas can provide the large, around-the-clock power supply data centers require. Meta, for example, is relying on the fuel to power its hulking four million-square-foot data center complex in northeastern Louisiana.

And the glut of green power applications can be traced to subsidies afforded through the Inflation Reduction Act, which Trump administration officials argue meddled in the market and discouraged investment in gas plants.

“President Trump is expanding base load power from reliable energy sources like natural gas, coal and nuclear to support growing electricity demand from AI and data centers,” said Taylor Rogers, a White House spokesperson. “Intermittent and unreliable energy sources like offshore wind that were propped up by the Green New Scam simply cannot generate the sustained power needed to make the United States the global leader in cutting-edge technologies like AI and quantum computing.”

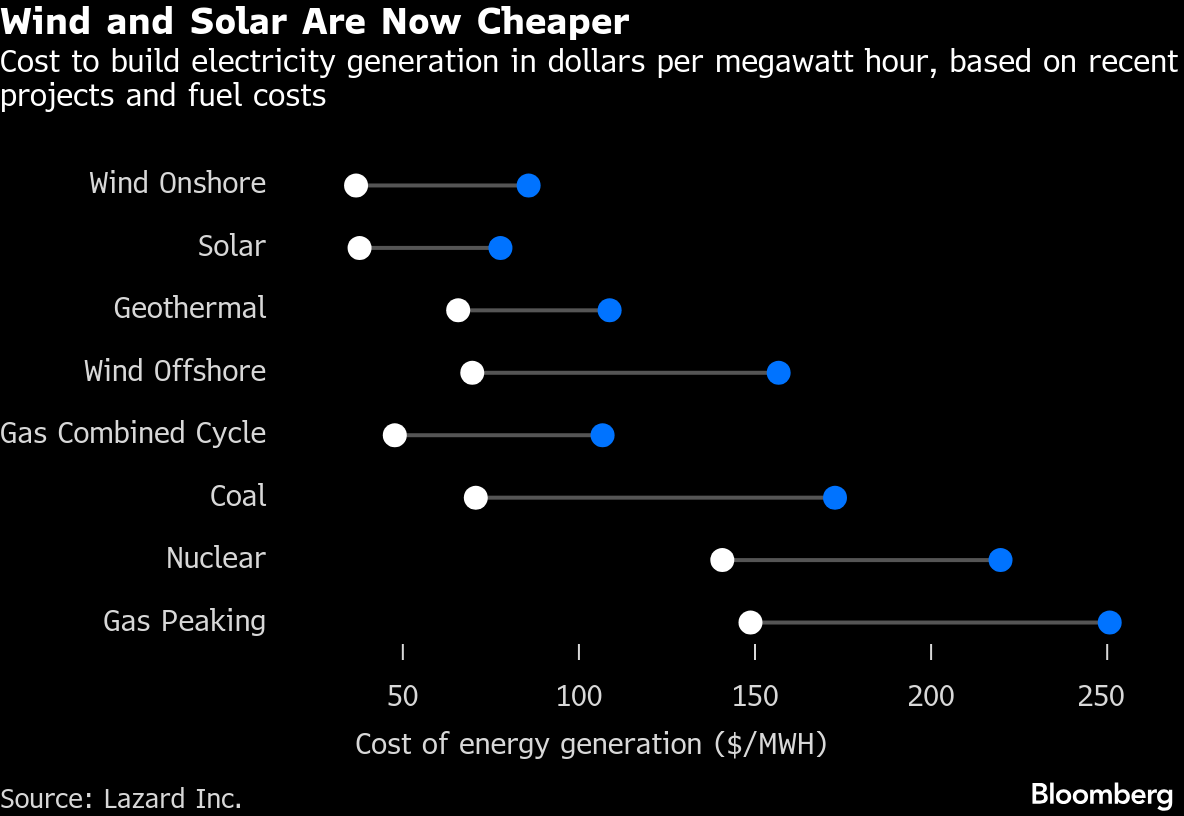

But the cost to build solar and wind farms plummeted in the years before those incentives were scrapped. Meanwhile, building up enough gas and nuclear plants to power data centers may prove too slow and expensive. Gas turbines, critical equipment to turn natural gas into electricity, are in short supply, and even though Trump is moving to accelerate permitting of the next generation of small-modular nuclear reactors, the next wave of those aren't expected to be built until the end of the decade at the earliest.

A growing mismatch

In the US, power consumption from data centers is expected to nearly triple by 2035, according to BloombergNEF. The surge, along with rising demands from manufacturing and electrification, is akin to the US having to power up to 190 million new homes by 2040, according to the American Clean Power Association, a trade group.

Coal probably won’t move the needle much. At this point, power from a new coal plant would cost at least $71 per megawatt-hour of capacity, compared with around $38 for solar or wind, according to Lazard Inc. And they take far longer to build.

Meanwhile, the amount of energy that can be squeezed out of incumbent coal plants — either through increased utilization or delayed retirement — is modest, according to BloombergNEF.

Even after recent policy shifts, including a $625 million grant program to subsidize coal, Wood Mackenzie expects US megawatts from the fuel to decline every year going forward.

Natural gas is more cost competitive at the moment and quicker than coal to build. Gas is tied to 13% of capacity from planned power plants, which are proposed to come online over the next 10 years or so, according to Cleanview.co data. However, that lever can’t be pulled much farther, at least in the short term. Some 70% of the world’s gas turbines come from just three companies; their inventory is largely spoken for over the next decade and they’ve shown little appetite to add capacity.

Nuclear, which Trump is promoting by speeding up regulatory approvals and committing at least $80 billion to develop reactors, is making a comeback, albeit a tiny one.

At this point, battery storage systems, solar arrays and wind farms are faster and cheaper to build per kilowatt of capacity than anything else, according to Lazard.

Most solar, batteries and wind farms don’t require lengthy air-quality permits, and thus take less than five years to complete. Some are built within a year-and-a-half, according to BloombergNEF. The timeline for deploying natural gas plants is three-and-half to five years on average, and will likely grow longer due to supply chain backlogs, it said. Lead times for utility-scale gas-fired plants have stretched by 35%, or more than a year, since 2023, its analysis shows.

It follows that more than nine out 10 power plants in the pipeline — roughly 5,700 facilities — are tied to renewables, according to Cleanview.co.

Cleanview founder and CEO Michael Thomas notes many of those plans were drawn up during Biden’s presidency and ultimately won’t make it to completion. With federal subsidies for wind and solar plants ending by 2028, some won’t pencil economically. Others are placeholders for utilities that will decide later which fuel source to go with.

For example, the largest planned solar complex in North America — a collection of projects called Esmeralda Seven — had its environmental permit review cancelled by the US Interior Department in October. Developers will need to apply for individual approval from an administration that isn’t in favor of big solar projects on federal land.

Officials could trip up other projects as well, according to the Solar Energy Industries Association, a trade group. It estimates that new solar and energy storage projects, which make up more than half of new power plant proposals, haven’t been fully permitted and are at risk.

Still, applications are a measure of intent and the feasibility of various options. Despite the rhetoric from the White House, a lot of renewable projects are likely to get the green light because AI developers are moving so quickly, Thomas said. Indeed, delays for new solar plants are in decline, according to federal data.

“There’s a lot of theater around this — what the Trump administration says and then what it does,” he added. “Things are still getting permitted and built. And people are just trying to fly under the radar.”

The head of one of the biggest renewable energy developers in the US told investors on Nov. 5 that the data center industry still wants clean energy to power its operations.

“Look, that's what can get built in this window," said Andres Gluski, CEO of AES Corp. "There can be talk about nuclear or other technologies; those take years to build. So what is going to meet the majority of the demand? Well, this year it's probably going to be 90% renewables and batteries, and it very likely will be next year as well."

The big tech companies are signing power contracts with natural gas to get round-the-clock power, but say they are still committed to their clean energy goals. As some hyperscalers sign deals to pipe in natural gas directly into their facilities, they are buying contracts for clean power projects that will result in more renewable energy hitting the grid, according to BloombergNEF analyst Nayel Brihi. In the first half of 2025, Meta, Microsoft Corp., Amazon.com Inc. and Google contracted for 9.6 gigawatts of clean energy, or the equivalent of 7.2 million homes, to be delivered to the US over the coming years.

Ultimately, the mismatch between the speed at which companies are building data centers and that at which electricity generation is coming online bodes well for renewable energy. When Trump’s Big Beautiful Bill gutted green energy subsidies, Wood Mackenzie lowered its projection for renewable power plants, but only by 8%. By 2034, the company expects US utilities to add another 666 gigawatts of power from solar, storage and wind, compared with just 126 gigawatts of gas-fired electricity.

Whaley, at Wood Mackenzie, doesn’t expect Trump to stop publicly opposing renewable energy. However, away from the microphones, in the thorny weeds of energy policy, he figures conservative policymakers may quietly tolerate a deeper shade of green. Indeed, this year through September, renewable sources comprised 89% of new electrical generating capacity, according to the Energy Information Administration.

“MAGA has to be MAGA; they have to keep the base fired up,” Whaley said. “But privately, I think there will be concessions, because they don’t want to lose the AI race to China.”

©2025 Bloomberg L.P.