China’s Four-Year Energy Spree Has Eclipsed Entire US Power Grid

(Bloomberg) -- China is undertaking an energy-building boom unlike anything the world has ever seen, as Beijing seeks to ensure supply for power-hungry facilities that are key to dominating emerging industries of the future.

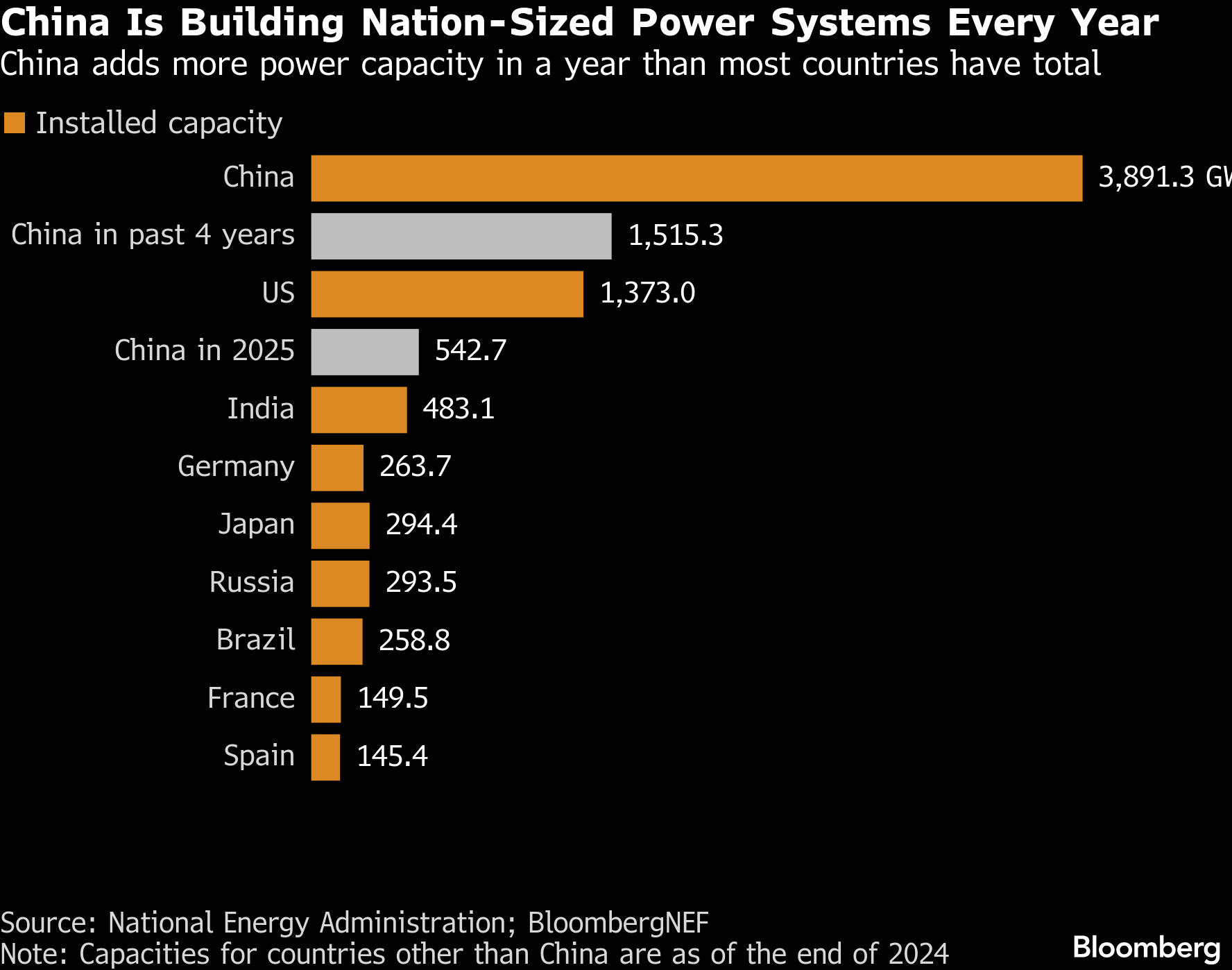

The nation added 543 gigawatts of new capacity across all technologies last year, according to data from the National Energy Administration on Wednesday. That’s 12% more than all the power plants combined in India as of the end of 2024. The generation China has added since the end of 2021 is also larger than the entire US system.

President Xi Jinping’s aims are to ensure a stable and abundant energy supply, limit dependence on fuel imports, and to hand a competitive advantage to growing, and energy-hungry, industries like artificial intelligence, robotics manufacturing and advanced materials — just as concerns rise those sectors could be constrained in the US by a lack of cheap electricity.

“The build-out remains very strong, with super robust numbers going from record to record,” said Michal Meidan, the head of China energy research at the Oxford Institute for Energy Studies. “The priority is security of supply, and not just that, but the availability of competitively priced energy.”

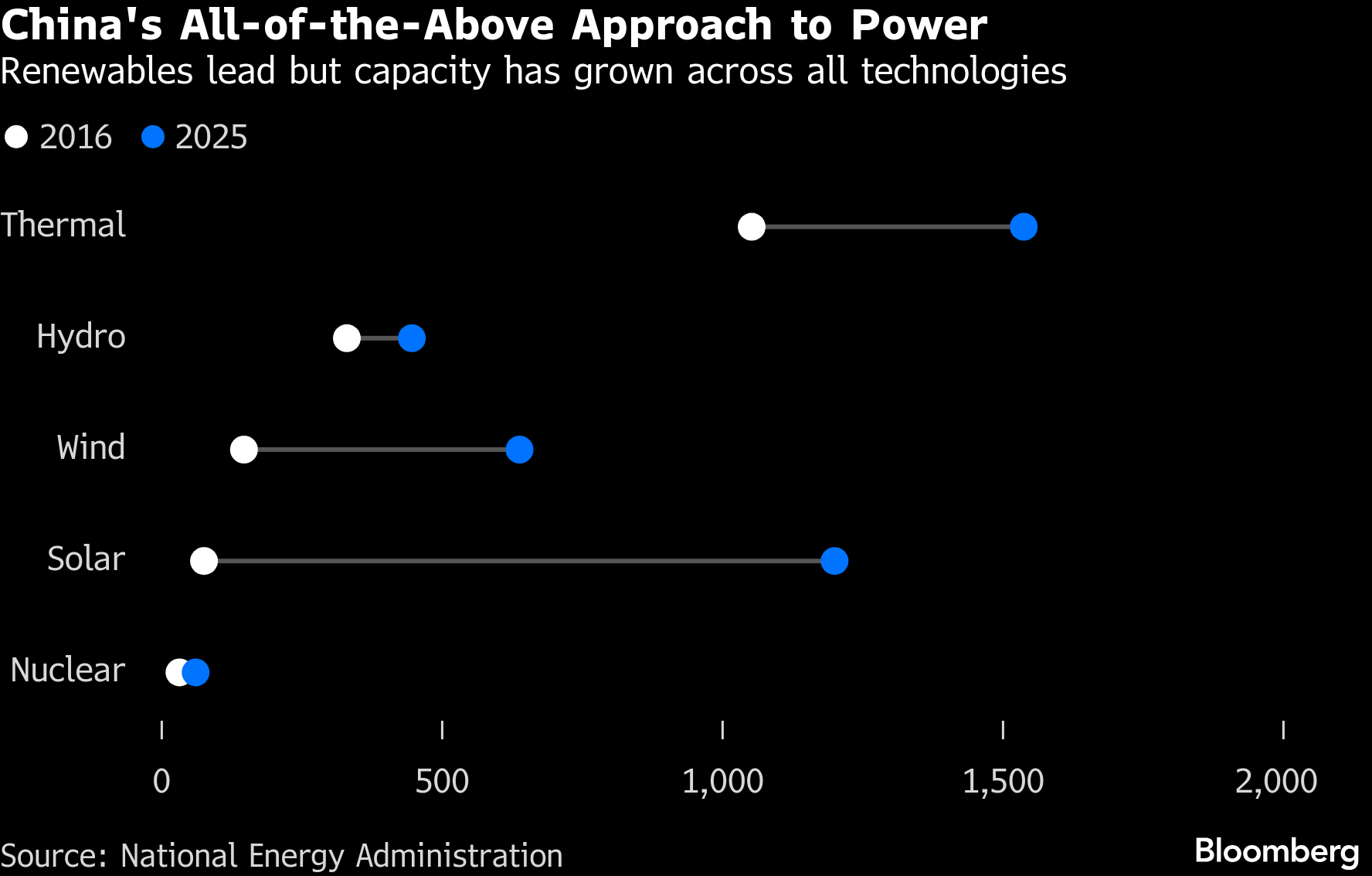

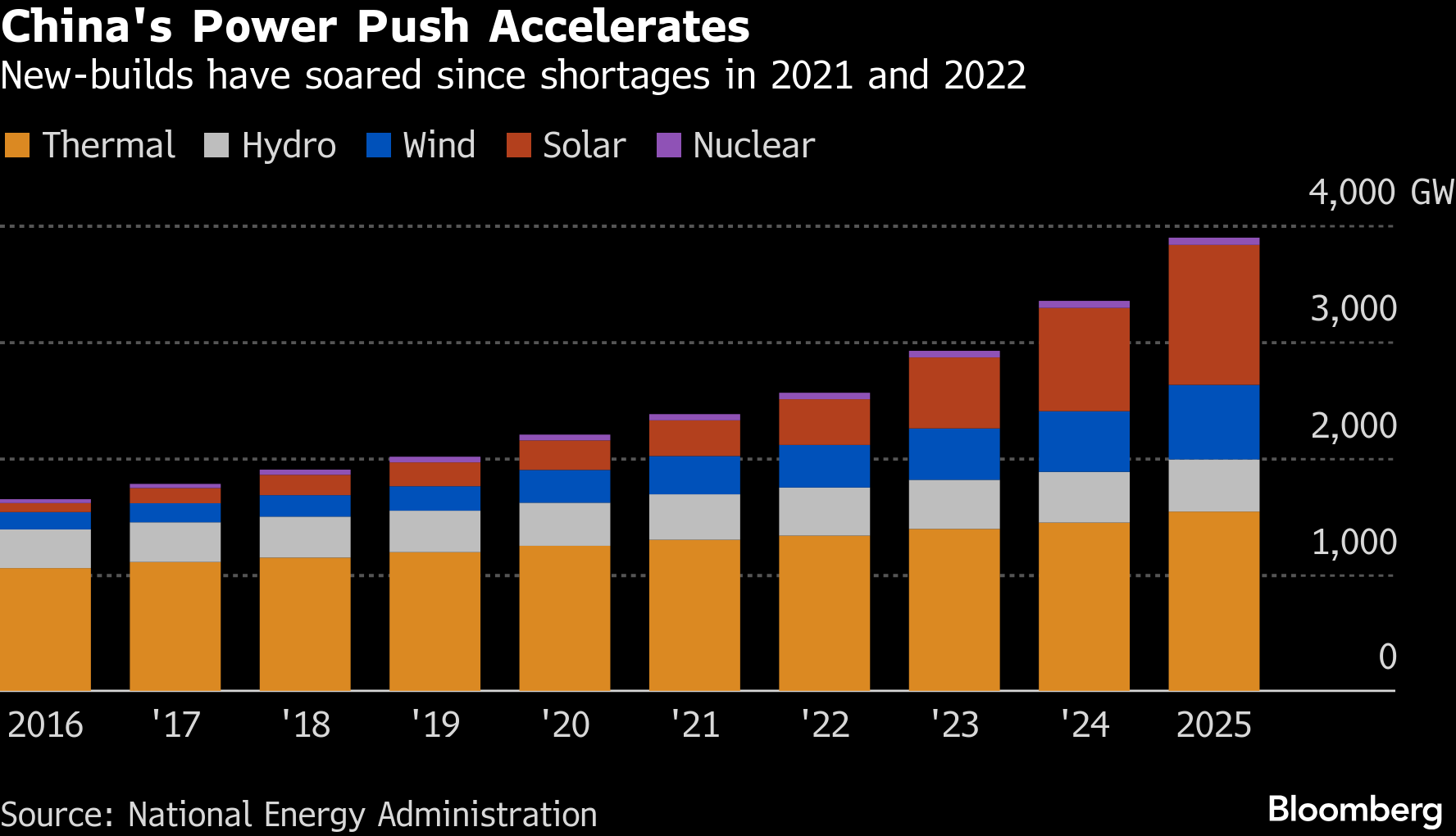

China is taking an all-out approach to energy sources. Solar accounted for more than half of new additions last year, while installations of wind farms and thermal plants that burn coal and natural gas were also at records, according to NEA data. Nuclear and hydropower posted smaller increases but are poised to play a much larger role in the future.

The nation has the world’s biggest pipeline for atomic reactor construction and is planning to make a massive hydropower project in Tibet the world’s largest power plant. Building officially started on the $167 billion facility in July.

Capacity additions have been far slower in the US after power demand appeared to plateau decades ago. Now, the country is struggling to meet the needs of power-hungry data sectors following the rapid development of AI, leaving electricity markets very tight, said Samantha Dart, the co-head of global commodities research at Goldman Sachs Group Inc.

“The US might face a bottleneck whereas China doesn’t seem to be bottlenecked at all,” she said. “Leadership in the AI race, which sits with the US now, might over time shift to China.”

China has been expanding its power system continuously since its industrial awakening in the 1990s, but the genesis of the recent boom likely stems from a series of electricity shortages in 2021 and 2022. Since 2023, capacity additions have averaged more than 400 gigawatts a year, compared to about 150 gigawatts annually over the previous six years.

Beijing now has to decide where things go in the future. The massive additions of wind and solar have at times overwhelmed the grid, leading to small rises in curtailment. And even as the country builds new coal power plants, all the new clean energy means they’re being used less.

“Coal plant retirements are really slow, utilization is dropping, and yet new capacity keeps being added,” said Belinda Schäpe, a China policy analyst at the Centre for Research on Energy and Clean Air. “ It’s becoming quite ridiculous.”

Another consideration is not all power capacity is created equally. A 1-gigawatt solar farm and a 1-gigawatt nuclear reactor might put out the same amount of power in the middle of a day, but over the course of a year, the atomic plant will produce far more electricity.

Recent policy releases indicate that if the past few years were about scaling up, the next few may be about building up the grid and reforming markets and systems to make sure capacity is better utilized. New rules put in place in June cut power rates for wind and solar and are expected to cause a slowdown in new installations, according to BloombergNEF forecasts.

Still, as the government prepares to release its work plan that will provide an economic blueprint for the 15th Five-Year plan through 2030, it’s clear that it won’t risk slowing down so much that it risks security of supply.

“Energy must support industrial innovation, upgrading, and technological advancement — that’s the core of China’s economic policy for the 15th Five‑Year Plan,” Oxford Institute for Energy Studies’ Meidan said.

©2026 Bloomberg L.P.